Post Note: Ian Runge bought some more shares, 25000 on market on November 5 for $17500.

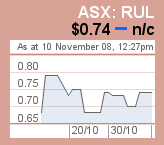

Post Note: Ian Runge bought some more shares, 25000 on market on November 5 for $17500. Directors Buy - Runge LTd (RUL)

Post Note: Ian Runge bought some more shares, 25000 on market on November 5 for $17500.

Post Note: Ian Runge bought some more shares, 25000 on market on November 5 for $17500. Among them were Anthony Kinnane who directly and indirectly bought 25000 shares for $18000 on market on 24 October 2008, Christian Larsen (bought 100000 shares worth $93500 on September 1, and Vince Gauci

RUL's vision is to be the leading global supplier of mine technical and business planning products and services. The company continues to strengthen its position globally, with demand for projects in new regions of the world. Demand from regions such as Russia, Brazil and China provide a solid foundation for the growth of its business globally. In terms of products and services, the company has been working on increasing the scope and size of the training business to handle a higher volume of recruits, and secondly, to reduce the complexity of its software products.

Subscribe to:

Post Comments (Atom)

1 comment:

This one I dare not touch. The reasons is my own personal opinion only.

Question 1:- If it is so good why did the previous management sell out?

Question 2:- It has a fair bit of debt.

Question 3:- It is very thinly traded, can I dispose of it readily at a fair "market price". Often with thinly traded stock the seller is a "price taker" i.e the buyers set the price.

Post a Comment