Holiday

Press the Ignore Button!

Is It Worth the Paper It's Written On?

ALAN KOHLER: And so you’ll sue them next April if they don’t pay, is that right?

TREVOR ROWE: We will if they don’t pay in April we have an obligation under the underwriting agreement that we need to pursue the collection of any outstanding instalments, but we get the money anyway because it’s underwritten by Deutsche Bank and Macquarie Bank.

ALAN KOHLER: But you are obliged to pursue the people.

TREVOR ROWE: We are obliged to pursue people.

ALAN KOHLER: And so are you going to do that? Is in there any alternative that you’re looking at? Is there any possible alternative?

TREVOR ROWE: We have an obligation to use best efforts to recover those funds. So in a balanced way we will have to do that.

ALAN KOHLER: What will that involve? Will you put the debt collectors on to them?

TREVOR ROWE: We’ll probably have debt collectors go out and endeavour to collect it, yes.

The Cycle of Market Emotions

Sympathy does not seem appropriate

The geniuses at Porsche have just done what half the civilised world has been thinking of doing these past few weeks and stuffed it to hedge funds and banks. The numbers are still all over the place as people try to unravel the great Stuttgart Sting. But what appears to have happened is this.

Porsche had been itching to buy Volkswagen for years. But it was struggling to raise the money. So instead of getting a traditional bank loan or issuing equity, it decided to pick the pockets of British and American hedge funds, the very funds, in fact, which have belittled stodgy old German enterprise and called it out of date. The funds which one leading German politician called "locusts" for preying on businesses while adding no value.

These funds thought VW was overpriced and reckoned Porsche was insane trying to buy it. It was nothing but a quixotic fantasy of Ferdinand Piech, the grandson of Porsche's founder and a former chief executive of VW. Porsche, after all, had annual revenues of just £5.2bn to VW's £83bn. Its market cap was around a third of its takeover target.

British and American hedge funds have belittled stodgy old German enterprise and called it out of date

But Piech's intimate knowledge of VW had allowed Porsche to make enormous profits trading options on VW stock. What occurred over the weekend was the climax of this strategy. Hedge funds such as SAC and Greenlight in the US and Odey and Marshall Wace in London were eagerly shorting VW stock; borrowing, selling it and promising to return it later. They reckoned the stock price would fall and they could buy it back cheaply and pocket the difference.

What Porsche appears to have known, however, is that the volume of available shares was quickly dwindling. They knew this because they had been quietly building their own position in VW, through shares and derivatives, to 74 per cent of the firm. A further 20 per cent was owned by the government of Lower Saxony, and another five per cent owned by index tracking funds, leaving a tiny number of shares floating freely on the market.

It is conceivable that Porsche and its banks were the ones lending the hedge funds the shares and then buying them back through proxies. So while the hedge funds thought there was a large and liquid market in VW shares, Porsche knew otherwise.

On Sunday afternoon, Porsche played its hand. It announced that it controlled 74.1 per cent of VW. German law had not required it to disclose this information beforehand. The hedge funds did their calculations and freaked out. They had borrowed 15 per cent of VW and now it turned out Porsche may have lent them most of that.

They immediately began scrambling for what little stock was out there to close out their short position. Some were reported to be sobbing on the phone to their brokers. Too many traders chasing too little stock sent the price of VW soaring, pushing the company at one point on Monday past Exxon to make it the most valuable in the world. All Porsche needed to do at this point was sit back and smile. It had made billions in paper profits.

‘The chaos around VW overwhelmingly hit professional gamblers. Sympathy does not seem appropriate’

Then came the reckoning. On Wednesday Porsche announced it would release five per cent of VW's stock to ease pressure on the short sellers. The share price of VW is still around two-and-a-half times where it was last week and Porsche could make around £5bn on this portion of its manoeuvre alone.

But even better, Porsche owned cash-settlement call options on 31.5 per cent of VW which, according to the New York Times, matured yesterday. If true, this earned them the difference in cash between 31.5 per cent of VW valued around last Friday's closing price of 210 Euros per share and yesterday’s price of 517 Euros, an astonishing return. When VW's price returns to normal, Porsche should have more than enough cash to buy control.

Germany seems to be on Porsche's side in all this. Die Tageszeitung, a liberal newspaper, wrote on Wednesday: "As opposed to previous speculative bubbles that cost a lot of small investors their money in the stock exchange casino, the chaos around VW shares overwhelmingly hits professional gamblers. Sympathy does not seem appropriate."

Naked short selling

John Templeton

- He is one of the past century's top contrarian.

- Looking for value investments, he called it 'bargain hunting'

- Search for companies that offered low prices and an excellent long term outlook.

- As a value-contrarian investor, he believed that the best bargains were in stocks that were completely neglected, those that other investors were not even studying.

Valuation of Stocks

Accounting wise, apparently it depends on how you calculate it. All the hype about the ‘Mark to market accounting’, which is the accused culprit of our current financial crisis. Well again, of course nobody made a mistake in dealing their business. It’s all about accounting. Right? Wrong!

Mark to market accounting, or also known as fair value accounting requires a close look at the risks in order to assess value. Did the trouble banks and financial institution looking closely at the risks? If institutions were accurately marking the books, they would have seen the problems they were experiencing months in advance and could have made the necessary adjustments, and we could have avoided the current crisis

Anyway, on the new development of this issue, Accounting bodies in the US and Europe responded by changing a few rules.

The International Accounting Standards Board (IASB) has confirmed a change to its rules allowing some assets to be reclassified and avoid be subject to a fair value calculation. The changes allow some assets to be moved from ‘held for sale’ or trade, which means using a fair value calculation, to ‘held for investment’ which does not. Deutsche Bank took advantage of new accounting rules, and shifted the income statement into a profit instead of a loss

SEC and the Financial Accounting Standards Board issued a clarification of the rules to say that “when an active market for a security does not exist, the use of management estimates that incorporate current market participant expectations of future cash flows, and include appropriate risk premiums, is acceptable.” It added that “the results of disorderly transactions are not determinative when measuring fair value,” which could mollify concerns about assets being marked down to fire-sale prices.

Whatever the accounting bodies decide, I hope it’s for the interest of everybody, especially investor, and I am not going into detail about the issue in this post.

Now, Back to the question: What is a value of the stock?

In accounting, there are several alternative in valuing the stock: It might be slightly different in some textbook, but basically one of the well known methods is a discounted cash flow (DCF)..

How does DCF analysis work? In simple terms a business is worth the present value of the cash flows that it will generate into the future. Those are the after tax cash flows available to shareholders – from today to forever. To calculate the after tax cash flows available to shareholders you will start with the revenues a business generates and deduct all the cash-based expenses that are incurred in obtaining those revenues (including taxes and capital expenditures).

Most corporate finance professionals are using this method.

However, apparently, Citigroup analysts have recently shifted from a discounted cash flow model of valuation to an enterprise value model.

The Enterprise value (EV) represents a company's economic value -- the MINIMUM amount someone would have to pay to buy it outright. An enterprise value model adds up the market cap and debt a company has, and then subtracts cash and cash equivalents.

Using an enterprise value model for a company shares could means, well, the end of the business itself. It means the analysts thinks that the company has a zero earning power, hence kaput!!

Lorenzo

China Story

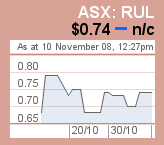

Directors Buy - Runge LTd (RUL)

Post Note: Ian Runge bought some more shares, 25000 on market on November 5 for $17500.

Post Note: Ian Runge bought some more shares, 25000 on market on November 5 for $17500. Runge director Ian Charles Runge indirectly bought 93,000 shares for $68,064 on-market on October 31. He indirectly holds 15,903,389 shares.

Ian was one of three or four Runge Directors who bought more into the company recently. Since October 2008, there are five notices of change in the directors ownership.

Among them were Anthony Kinnane who directly and indirectly bought 25000 shares for $18000 on market on 24 October 2008, Christian Larsen (bought 100000 shares worth $93500 on September 1, and Vince Gauci

Good sign and a vote of confidence.

RUL's vision is to be the leading global supplier of mine technical and business planning products and services. The company continues to strengthen its position globally, with demand for projects in new regions of the world. Demand from regions such as Russia, Brazil and China provide a solid foundation for the growth of its business globally. In terms of products and services, the company has been working on increasing the scope and size of the training business to handle a higher volume of recruits, and secondly, to reduce the complexity of its software products.

Runge reported NPAT up 6.2% to $5.94m for the year ended 30 June 2008. Revenues from ordinary activities were $63.41m, up 62.8% from last year. Basic EPS was 5.3 cents compared to 3.3 cents last year. Net operating cash flow was $5.9m compared to $6.35m last year. The final dividend declared was 1.5 cents.

Investing Tip 1: Don't Try to Catch a Falling Knife

Start looking for value playsTomas J. O'Loughlin, CFA, of Investment Portfolio Management, suggests that the best investment decisions in hard economic times are counterintuitive.

"Sectors or companies that you liked in good times but have been hit in today's markets may represent buying opportunities."

Buying the best of breed in these sectors can position investors to take advantage of the next bull market.

| His checklist in evaluating these firms includes: | ||||||||

|

An investor can't be in a hurry to buy or sell, says O'Laughlin.

"Don't try to catch falling knives," says O'Laughlin, and "try to get a measure of the firm's downside risk."

By looking at the downside risk of firms and by taking an investor's perspective, looking over a three- to five-year investment horizon, versus a trader's point of view, the investor can identify firms with value, O'Laughlin says.

From: http://www.bankrate.com/cnbc/news/investingadvice/tips-for-investing-a3.asp?caret=2a

White Knight Vs Red Dragon

This is from The Daily Reckoning in its newsletter yesterday:

Are these Chinese firms white knights or red dragons? Does it really make a difference? We're back to the same question of who benefits the most from the long-term demand for the ore. The Chinese steel producers have the chance of a lifetime to secure off-take from Australian mines at bottom-of-the-barrel prices. But what does it mean for current or future shareholders in the juniors?

Here's what Al says, "In short, the steel sector will huddle together for warmth over the next six months. We're going to see demand for steel and steel-making ingredients move down slowly. Then the recovery will come from developing countries later in 2009."

"But right now, the balance of power has definitely shifted. You'll see more of these iron-steel project equity agreements in late 2008 and early 2009. It's a way for both parties to get some security. It's a way to wring some risk out of the contracts. And it's yet another step towards where we see the iron industry inevitably heading: Chinese firms owning a lot more of Australia's iron mines."

"Shareholders in the juniors will be in for volatility. It still isn't clear in the long run who will control the Pilbara. But right now Australian iron ore shares are factoring in a global depression. The buyers are completely ignoring the growth in the developing world that'll come in the next decade. Better yet, our favourite iron play is still sitting on the sidelines - making cash every quarter regardless of who owns the mines."

Ansell Limited

Ansell's principle activities involve the development, manufacturing and sourcing, distribution and sale of gloves and protective products in the Professional Healthcare, Occupational Healthcare and Consumer Healthcare markets. Ansell is one of the companies in the Healthcare industries that has doing pretty well in the current financial crisis.

Ansell's principle activities involve the development, manufacturing and sourcing, distribution and sale of gloves and protective products in the Professional Healthcare, Occupational Healthcare and Consumer Healthcare markets. Ansell is one of the companies in the Healthcare industries that has doing pretty well in the current financial crisis.Telstra today - 5 Nov 2008

Citigroup maintain their HOLD recommendation on Telstra (TLS) and 465c target price saying they don’t expect any earnings upgrade at the TLS Investor Briefing tomorrow.

Citigroup maintain their HOLD recommendation on Telstra (TLS) and 465c target price saying they don’t expect any earnings upgrade at the TLS Investor Briefing tomorrow. Fundamental Analisys (I)

There are different of aspects that we can look into, but there are few basic things that we can start to look into:

1. Earning,

- Arguably one of the most important aspect of any business. Stock investors are focus on the future earning. However, since future is difficult to predict, they use the historical earning as a gauge to predict the future.

- Although looking at earning figures seems to be relatively easy, unfortunately there are few of different ways to look at a company's earning. This include the time of earning and the quality of earning. We will go into more detail of this earning in another post.

2. R/E Ratio

- P/E Ratio is calculated by dividing a stock price by its per share earning for a given years. Usually, we calculated the P/E based on a company expected earning ( this is what is called Forward P/E).

- It is a good place to start to determine the value of a stock, and it certainly most helpful to compare it against other P/E Ratios

- We might first compare it with the company's P/E ratio in the past, how high and how low it could go. Other than that we can also compare it with other similar company in the industry or the stock market index.

- Just because a stock has a relatively low P/E ratio, does not always mean it's worth purchasing. Others maybe aware of a looming problems and discounted the stock price accordingly. It can either good or a bad sign, always do your reasearch first.

3. to be continued...

What a Misjudgement!

Mount Gibson Iron (MGX) is back on the trade floor today, ending a week long suspension. It announced an offtake agreement, right issue and placement of 110m shares at 60c.

At least the company did not go to the darker place, but this is the same (or not the same) company who fought against the bought out at $3+ few months ago. The same predator is now getting 110 million shares at a 90% discount!!

I suppose this is as good as you can hope for.

Bank and the Borrowed Money!

Debt or borrowed money, became a huge industry around the world. The world turn away from manufacturing and toward an economy based on moving and managing money.

In the US itself, the sectors of finance, insurance and real estate sector swelled to 20% of GDP, ahead of manufacturing at 12%. Banks and insurers are dealing with obsecure instruments, debt papers, CDO. What a nightmare!

I Don't Think It Can Get Much Worse

I am looking at an over 500 point loss in the Dow without feeling a thing, a 15% down in Hongkong felt like watching something amusing and a circuit breaker suspension at Nikkei just like a heartbeat.

Watching AUD

I'll put it in capital letters : HOPEFULLY! (as investor seems to have priced in nearly all worst case scenarios).

Just Stay on the Beach, Out of the Water!!

In the current stock market's condition, probably is best to do nothing at this moment.

Capitaling and holding on to the cash is not a good idea for some reason and putting your toe in the water is probably not the best action either.

Best thing is to be cautious, unlike what I have done last week, when I put a stack of cash from my husband's account into MGX (Mount Gibson Iron). I got MGX reasonably cheap, I think, but then turn out that I was catching a fallen knife. Ouch!!

I am Witnessing a History

Survivors - Australia

PanAust (PNA.ASX)

Change of director's ownership, 8 September 2008 – Garry Arthur Hounsell bought 500,000 of PNA shares (average price $0.7015 - hence total consideration of $350.750)

----

PNA reported yesterday a half year (1st) net loss of US$389,000. This result was better than expected.

From the broker:

- GSJB Were keep a BUY recommendation with a target price of $1.40. JB Were still like the PNA story, and said the next 6-18 months is a great period of opportunity for PNA due to its work in the Phu Kham project in driving it to become a profitable and cash generating business.

- RBC Capital Market (before the above report):

Outperform recommendation, share price target of $1.40

A LIFT in its long-term price forecast for copper has meant a change in the recommendation for Pan Australian Resources by RBC, moving from sector perform to outperform. RBC's new copper price forecast is now US25c-50c per pound higher for all years while its long-term price forecast has moved US20c per pound higher to $US1.50 per pound. - Credit Suisse Outperform recommendation 12-month target price of $1.50. PANAUST has delivered a maiden resource for its Ban Houayxai deposit in Laos of 19 million tonnes at 1.7 grams per tonne of gold and 10 grams per tonne of silver. PNA is looking to build a reserve to support a 100,000 ounce per annum gold operation with first production in 2011. The analysts said the asset, while a modest grade, had many advantages, including cheap power, installed infrastructure, low strip ratios and good recoveries. It is expected further drilling is likely to increase resources, given that the asset is open to the north and at depth.

"In common with ASX-listed copper peer EQN we think PNA is outstandingly inexpensive," Credit Suisse said. "Pan Australian offers quality exposure to copper leverage and a wide open register makes it vulnerable to takeover."

Reporting Season Update

- Industrea reported a record profit of $41.3 Million, up 122%. Revenue from ordinary activities up 192% from 65.6M to 192M. IDL also reported a fully franked dividend of $0.01 per share, record date 3 October 2008.

- Tassal Group has also posted another impresive result, with NPAT of $21.200 Million for the full year, an increase of 32.6%. TGR declared an unfranked final dividend of 3.5 cents per share, brought the total dividend for the year to 6.5 cents per share. Record date: 2nd October 2008.

- REX airlines reported an increase of 15.7 % in revenue, and a modest 3% increase in NPAT. Profit after tax increased as a result of higher revenue, cost containment measures via productivity commitee, Pel-Air, and Australian Airline Pilot Academy impact. REX also reported a fully franked dividend of $0.066 per share, record date 31 October 2008.

- IBA Health reported a net profit of $14.6 million for the year ended 2008, down from $22.9 million last year. EBITDA was $105.6 M, up from $32.3M (above guidance range), yet revenue at $360.9 M was below guidance. No dividend declared.

- OZ Mineral declared an interim dividend of $0.05 per share, unfranked. Ex dividend date is 28 August 2008, record date 03 September 2008.

- Mount Gibson Iron (MGX), reported a record full year NPAT of $113.3 M, up 137% from previous year. Cash on hand $48.7 M, debt drawn on June 2008 $ 105 M. No dividend declared.

- Runge Limited, reported an NPAT of $8.0M, an 11% increase to the forecast proforma NPAT in Runge IPO's prospectus. RUL declared a fully franked dividend of 1.5 cents per share (payable on 6 October 2008).

How to 'Bear' a Bear Market

Adapt To A Bear Market

Wednesday June 25, 7:40 pm ET

Ryan Barnes

Witnessing a bear market for stocks doesn't have to be about suffering and loss, even though some cash losses may be unavoidable. Instead, investors should always try to see what is presented to them as an opportunity, a chance to learn about how markets respond to the events surrounding a bear market or any other extended period of dull returns.

Read on to learn about how to weather a downturn.

What is a Bear Market?

The boilerplate definition says that any time broad stock market indexes fall more than 20% from a previous high, a bear market is in effect. Most economists will tell you that bear markets simply need to occur from time to time to "keep everyone honest". In other words, they are a natural way to regulate the occasional imbalances that sprout up between corporate earnings, consumer demand and the combination of legislative and regulatory changes in the marketplace.

Cyclical patterns of stock returns are just as evident in our past as the cyclical patterns of economic growth and unemployment that have been around for hundreds of years.

Bear markets can take a big bite out of the returns of long-term stockholders. If an investor could, by some miracle, avoid the downturns altogether while participating in all the upswings (bull markets), their returns would be spectacular - even better than Warren Buffet or Peter Lynch.

While that kind of perfection is simply beyond reach, savvy investors can see far enough around the corner to make adjustments to their portfolios and spare themselves some losses.

These adjustments are a combination of asset allocation changes (moving out of stocks and into fixed income products) and switches within a stock portfolio itself.

When the Bear Comes Knocking

If it appears that a bear market could be around the corner, get your portfolio in order by identifying the relative risks of each holding, whether it's a single security, a mutual fund, or even hard assets like real estate and gold.

In bear markets, the stocks most susceptible to falling are those that are richly valued based on current or future profits. This often translates into growth stocks (stocks with price-earnings ratios(P/E ratios) and earnings growth higher than market averages) falling in price.

Value stocks, meanwhile, may outperform the broad market indexes because of their lower P/E ratios and the perceived stability of earnings. Value stocks also often come with dividends, and this income becomes more precious in a downturn when equity growth disappears.

Because value stocks tend to get ignored during bull runs in the market, there is often an influx of investor capital and general interest in these stodgy companies when markets turn sour.

Many young investors tend to focus on companies that have outsized earnings growth (and associated high valuations), operate in high-profile industries, or sell products with which they are personally familiar. There is absolutely nothing wrong with this strategy, but when markets begin to fall broadly, it is an excellent time to explore some lesser-known industries, companies and products.

They may be stodgy, but the very traits that make them boring during the good times turn them into gems when the rain comes.

Seek Out Defensive Investments

In working to identify the potential risks in your portfolio, focus on company earnings as a barometer of risk. Companies that have been growing earnings at a fast clip probably have high P/Es to go with it. Also, companies that compete for consumers' discretionary income may have a harder time meeting earnings targets if the economy is turning south. Some industries that commonly fit the bill here include entertainment, travel, retailers and media companies.

You may decide to sell or trim some positions that have performed especially well compared to the market or its competitors in the industry. This would be a good time to do so; even though the company's prospects may remain intact, markets tend to drop regardless of merit. Even that "favorite stock" of yours deserves a strong look from the devil's advocate point of view.

Identify the Root Causes of Weakness

It may take some time for a consensus to form, but eventually there will be evidence of what ended up causing the bear market to occur. Rarely is one specific event to blame, but a core theme should start to appear; identifying that theme can help identify when the bear market might be at an end. Armed with the experience of a bear market, you may find yourself wiser and better-prepared when the next one arrives.

A Case Study: 2000-2002 Bear Market

Consider the bear market that occurred between the spring of 2000 and the fall of 2002, often referred to as the "tech bubble" or dotcom bubble. As the monikers suggest, the problems in this market began with technology stocks, as evidenced by the more than 60% drop in the tech-laden Nasdaq index. But weakness in a few sectors quickly spread, eventually dragging down all corners of the equity map. Even the blue-chip Dow Jones Industrial Average (DJIA) fell over 25% during the period.

Leading up to the year 2000, the explosion of the internet led to dramatic innovations in all areas of technology, including data servers, personal computers, software and broadband transmission systems like fiber optics and cable. By the late 1990s, any company remotely involved in the internet had a sky-high market cap, giving it access to very cheap capital.

Stocks with little or no earnings were suddenly worth billions, and used their stock currency to buy other companies, obtain bank credit and expand operations.

Meanwhile, non-tech based companies felt the need to get caught up technologically, and spent billions on equipment as well as activities related to "Y2K" preparation, further inflating demand for tech products, but it was an artificial demand that could not be supported over time.

The Snowball Effect

As always happens near the peak of a bubble or bull market, confidence turned to hubris, and stock valuations got well above historical norms. Some analysts even felt the internet was enough of a paradigm shift that traditional methods of valuing stocks could be thrown out altogether.

But this was certainly not the case, and the first evidence came from the companies that had been some of the darlings of the stock race upward – the large suppliers of internet trafficking equipment, such as fiber optic cabling, routers and server hardware.

After rising meteorically, sales began to fall sharply by 2000, and this sales drought was then felt by those companies' suppliers, and so on across the supply chain. Pretty soon the corporate customers realized that they had all the technology equipment they needed, and the big orders stopped coming in. A massive glut of production capacity and inventory had been created, so prices dropped hard and fast. In the end, many companies that were worth billions as little as three years earlier went belly-up, never having earned more than a few million dollars in revenue.

The only thing that allowed the market to recover from bear territory was when all that excess capacity and supply got either written off the books, or eaten up by true demand growth. This finally showed up in the growth of net earnings for the core technology suppliers in late 2002, right around when the broad market indexes finally resumed their historical upward trend.

Start Looking at the Macro Data

Some people follow specific pieces of macroeconomic data, such as gross domestic product (GDP) or the recent unemployment figure, but more important are what the numbers can tell us about the current state of affairs.

Bear markets are largely driven by negative expectations, so it stands to reason that it won't turn around until expectations are more positive than negative.

For most investors - especially the large institutional ones, which control trillions of investment dollars - positive expectations are most driven by the anticipation of strong GDP growth, low inflation and low unemployment.

So if these types of economic indicators have been reporting weak for several quarters, a turnaround or a reversal of the trend could have a big effect on perceptions. A more in-depth study of these economic indicators will teach you which ones affect the markets a lot, or which ones may be smaller in scope but apply more to your own investments.

Position Yourself For the Future

You may find yourself at your most weary and battle-scarred at the tail end of the bear market, when prices have stabilized to the downside and positive signs of growth or reform can be seen throughout the market.

This is the time to shed your fear and start dipping your toes back into the markets, rotating your way back into sectors or industries that you had shied away from.

Before jumping back to your old favorite stocks, look closely to see how well they navigated the downturn; make sure their end markets are still strong and that management is proving responsive to market events.

Parting Thoughts

Bear markets are inevitable, but so are their recoveries. If you have to suffer through the misfortune of investing through one, give yourself the gift of learning everything you can about the markets, as well as your own temperament, biases and strengths.

It will pay off down the road, because another bear market is always on the horizon. Don't be afraid to chart your own course, despite what the mass media outlets say. Most of them are in the business of telling you how things are today, but investors have time frames of 5, 15 or even 50 years from now, and how they finish the race is much more important than the day-to-day machinations of the market.

From: http://biz.yahoo.com/investopedia/080625/3333.htmlAnalyst Review : REX Airlines

Stock to watch: REX

Recommendation: BUY -- Share price at the moment of the report was $1.08

Comment:

- Strong Growth Outlook

- In addition to strong fundamentals of the company, REX also in the market buying back 12 million shares. This is a good indication that REX is undervalued.

- Management interest - Directors increased stake in the company

------

Disclosure: I own REX, bought in at $1.055

So, I am Calming Down

Not that we can do anything about current condition of the ASX, anyway :) so why bother too much..

Back on the real life, here we are, start looking at the stock again.

All the stocks in my portfolio are looking just the same as where it was, despite the reporting season. The composition of my holding are mainly growth stock, from the resource/ mining company. Hence, not many will declare dividend this year.

MGX, OXR.. (I mean OZL), IBA has reported their results, and so did RUL. Great results for most, but you can guess what's happening to their share price, unchange much. OZL and RUL declared dividend, and for the first time, me and my husband decided to participate on ozl's DRP.

I guess, the best lesson for me on this trying time is just to keep calm, and focus in the long run, God knows, maybe I'll get the money back in two years time or so :)

Daily Investment Checking

And I thought I knew that too, but somehow I just can't help it..

Anyway, I am sure it's not too late to start :)

So this is what they say:

In Why Smart People Make Big Money Mistakes, the authors note that it's

dangerous to watch your investments every day. When you pay close attention, you

tend to become emotionally invested in even small movements. You lose sight of

the long-term and make decisions based on short-term events. Peek in every month

or so, but don't constantly check your investments.Also:

In conjunction with the idea that you should be long in the stock market, you shouldn’t watch the market every single day. Since a stock, depending on its volatility, is likely to jump and drop at essentially random, if you watch the performance of your stock every single day then you’re likely to read into those moves when there’s nothing to read. This may cause you to make a decision based on random events and not on the fundamentals, what should’ve caused you to purchase the stock in the first place.

Bank's Trouble in Our Yard

- NAB warned on Friday it had made an additional provision of $830 million for its exposure to complex credit derivatives, known as collateralised debt obligations, or CDOs.

- ANZ profit warning - said its cash earnings per share for the year to September 30 were expected to fall by 20-25 per cent from the previous year. Bad debt provisions in the second half would likely be around $1.2 billion due to sour loans to commercial property groups and margin lenders, up from $980 million in the first half.

- In the past - involvement (masive exposure) of ANZ banking group with Opes Prime, Tricom.

- More pain to come?

Mount Gibson Iron (MGX.ASX)

A quick peek from FN Arena Broker Call:

MOUNT GIBSON IRON LIMITED - 23 July,2008

Macquarie rates MGX as Outperform - The quarterly production result came in as expected. The broker notes Mt Gibson is "drilling madly" and organic growth is timed well for the peak of the iron ore price cycle.

Oxiana

This is Oxiana, made of OXR, Zinifex and AGM. It has Martabe and Prominent Hills, also more than a billion in cash. Commodity price is also higher.

The price now is the price of Oxiana some years ago, before all that I mentioned above.

REX Airlines

Why, REX?

Well, as I wrote few days/weeks ago, REX does have a lot of good qualities. It share price has been slammed to the low side for a while now, and I think it's enough bad news already. The fact that REX's share price hold, despite an ever increasing fuel price and other things, is a bit reassuring.

Oil price can't go up forefer (or can it?), so I guess it's my way of hedging my portfolio against the oil stock. I hold ARQ and BPT.

OXR/ZFX – Say Hello to OZ MINERALS

17 June 2008

OXR/ZFX – Say Hello to OZ MINERALS

Zinifex (ZFX) shareholders have now voted in favour of the proposed scheme of arrangement to merge with Oxiana (OXR) to create Australia’s fifth largest mining company. Renamed OZ Minerals (OZM) and with a market cap of circa A$8.4bn, the scheme was approved with by an astounding 97% of ZFX shareholders.

Macquarie Research Equities (MRE) provide some very interesting analysis on the deal and deliberate their guidance on the new global diversified miner…

The Deal Drivers

MRE believe the real catalyst for the merger is the ability to leverage ZFX’s balance sheet into OXR’s growth pipeline. In addition to this, the deal will further facilitate an aggressive acquisition strategy. OZM will essentially become the second largest global zinc producer and following the commission of Prominent Hill will be close to the top fifteen global copper producers

Global “Targetting” or Global Target

MRE believe that OZM will be aggressive in their growth strategy underpinned by brownfield expansions – i.e the development at Prominent Hill and Greenfield projects incl. Dugald River and acquisitions. However MRE also indicate that the merger will likely position the firm as a target for even bigger suitors, namely Teck Cominco and Xstrata.

Recommendation

MRE state that OZM is well placed to enter the ranks of the global diversified base metal miners. And in line with a strong balance sheet, there is also the expectation of an aggressive organic and acquisition growth strategy.

The complexity of market activity over the last 12 months has certainly caused considerable investment uncertainty. With many investors feeling the pinch in their margin lending accounts, perhaps a protected lending strategy in the mining sector would provide some comfort for investors still looking for Australian equity exposure.

Oxiana

Clear Buy at around $ 2.75 - 2.85.

A concern on Zinc price on the upcoming merger with Zinifex.

Cross Trade

A practice where buy and sell orders for the same stock are offset without recording the trade on the exchange, which is outlawed on most major stock exchanges. This also occurs when a broker executes both a buy and a sell for the same security from one client account to another where both accounts are managed by the same portfolio manager.

Typically, this is yet another way for a broker to rip you off. When the trade doesn't get recorded through the exchange, there is a good chance that one client didn't get the best price. However, cross trades are permitted in very selective situations such as when both the buyer and the seller are clients of the same asset manager. The portfolio manager can effectively “swap out” a bond or other fixed income product from one client to another and eliminate the spreads on both the bid and ask side of the trade.

The broker and manager must prove a fair market price for the transaction and record the trade as a cross for proper regulatory classification. The key point is that the asset manager must be able to prove to the SEC that the trade was beneficial to both parties before executing a cross trade.

(source: investopedia)

REX Airlines

Fact:

- Airline business is very risky. It is not for the faint hearted.

- Small, very high pilot turnover.

- Even Warren Buffet lost money in his 1989 investment on USAir.

- Massive fixed costs, strong labor union, skyrocketing oil price.

- Revenue is very sensitive to the change of demand among other things.

Considerations:

- Share price had been on sideways for quite a long time

- Not too many competitors, REX is the only option on 33 of its 39 routes

- No debt!! Owning 22 of its 38 passenger plane.

- There's been Share Buy Back recently

- Directors buying

- Own its own pilot training academy (expected to produce 80 graduates a year)

Re-Post: War, Oil Prices and Stock Market

THIS morning, news reported that world oil prices overnight hit new highs for 2007 as the market fretted over rising tensions between the West and major crude producer Iran.

Iran, OPEC's second largest producer and the world's fourth-biggest producer of oil, certainly plays a considerable part on the world oil supply.

How far will it go? Will it head to oil crisis again?

Looking back at the history, there were several events that trigger the oil crisis:

First Oil Crisis, 1973-4

- Arab countries’ retaliation for US support of Israel in Yom-Kippur war 1973.

- Triggered sharp recession around world.

- 1973-4 is second sharpest stock market crash in US history.

- S&P Composite lost 53% of its real value between Dec. 1972 and Dec. 1974. (Only worse two-year experience was June 1930 to June 1932.)

Second Oil Crisis, 1979-80

- Iranian revolution, expulsion of the Shah of Iran, Ayatollah, capture of US Embassy hostages in Teheran Nov. 1979.

- Iran-Iraq war erupts 1980, disrupts oil supplies. US CPI inflation reaches 18%/year in March, 1980. The “great recession”of 1981-82 is the worst recession since Depression of the 1930s.

Collapse of OPEC Cartel, 1986

- After suffering bombing by Iraq, Iran demands that Iraq be given the same oil export quota as everyone else.

- Other arguments about the disproportionate share of some OPEC states.

Persian Gulf War, 1990-1991

- August 2, 1990, Surprise invasion of Kuwait by IraqUN Security Council deadline for Iraq to withdraw by January 15 1991.

- January 16, 1991 Air bombardment of Iraq and its Kuwaiti positions begins.

- February 24, 1991 Allied ground invasion begins. War is over February 26, 1991.Brief interruption of oil supplies mark recession: NBER dates July 1990-March 1991.

Oil Price Collapse 1997

- Nov. 1997 OPEC Meeting, the “disaster in Jakarta” involved bitter disputes among OPEC nations about market share. Fuming about widespread cheating in limiting exports to quotas. Asian financial crisis dropped demand for oil

Oil Price Spike 1999

- OPEC resolve to stop cheating left supplies shorter than they expected

- Erroneous data led them to underestimate how fast inventories were dropping.

- Backwardation in oil futures market (futures price below spot price) began in January 1999. OPEC Increased quotas

Second Gulf War

- Oil SpikeIn anticipation of war, oil rises to nearly $36 per barrel

- February, 2003US invaded Iraq, March 19, 2003. Symbolic end of war: after capture of Baghdad, crowd topples Hussein stature April 8, 2003.

- Oil falls to $28 per barrel by April, 2003

2008 Oil spike

- Oil price spike to $135 per barrel

- Inflation is high around the world

- Stock Market tumble in what is said to be second worst to the 1930 Great Depression

Pump and Dump

I was wondering if what happen to Cockatoo coal's share price today

is a typical of pump and dump action, cashing out on coal stock hype!

Cockatoo down as much as 8%

What is Pump and Dump?

A scheme that attempts to boost the price of a stock through recommendations based on false, misleading or greatly exaggerated statements. The perpetrators of this scheme, who already have an established position in the company's stock, sell their positions after the hype has led to a higher share price.

This practice is illegal based on securities law and can lead to heavy fines.

The victims of this scheme will often lose a considerable amount of their investment as the stock often falls back down after the process is complete.

Traditionally, this type of scheme was done through cold calling, but with the advent of the internet this illegal practice has become even more prevalent.

Pump and dump schemes usually target micro- and small-cap stocks, as they are the easiest to manipulate. Due to the small float of these types of stocks it does not take a lot of new buyers to push a stock higher.

Claims about how a stock is set to break out should be met with a considerable amount of caution. It is important to always do your own research in a stock before making an investment.

Source: investopedia

Runge Lists on ASX at 11% Premium

Runge first traded at A$1.11 compared with an issue price of A$1 in the IPO, giving the company a market capitalization of A$135.3 million.

Runge intends to use the funds it has raised to add to recent acquisitions as well as chase organic growth in a sector it says has a favorable outlook, with the China-driven commodities boom sparking strong demand for mine planning consultants and mining technology.

-By Alex Wilson, Dow Jones Newswires

RUL closed at $1.18

Update

- Runge IPO was a sucessful one. Share price at this moment is $1.10. It went up as high as $1.15.

- Cockatoo Coal make a new high, went up 10% yesterday and 13% this morning. How high can it fly? Refer to my previous post.

- IBA secured a contract worth $2 million with Singapore based International SOS - the world’s largest medical assistance company - for a primary care solution at its clinics throughout Asia. A good news yet a smallish one.

- REX Airline reported third quarter earning rise of 8%. Not bad at all, considering the accute pilot shortage, oil price and financial crisis. REX's share price went up as high as 9%.

Runge Limited IPO

Hope things are going well tomorrow.

Runge has a lot of positive side to offer. Among them are:

- Strong client base

- Profitable company

- Not a business that a new player could enter that easily

- Commodities and mining boom.

I remember reading a book, written by my husband's great uncle, Albert Gaston, in his book "Coolgardie Gold". In this book that described the early Western Australia's Mining history, he said that the mine site's storekeepers and the Afghan drinking water seller made more money than most of the gold prospectors.

That's what Runge Ltd does: providing service to the miners.

Another Side of a Coin

The ASX? After a modest lost yesterday, actually it managed to stay on a green side today.

Australia is on the exporting side of oil and gas. Oil is Australia's fifth largest export. Not to forget other Australian alternative energy such as gas, coal and geothermal.

So, what is a record oil price mean?

Well, it depends where you are, I guess. For America, it might mean disaster, recession, inflation, and other not so nice attribute. For Australia, it means higher earning for our oil and energy company ( and of course a higher oil price that might pinch businesses and household hard). Still, it might worth it to invest in some australian energy company now. For short term at least.

Another side of a coin.

Not A Bad Oil Stock

This morning, Commsec had 2 strong buys and 4 moderate buys for BPT. Beach Petroleum, that is.

BEACH PETROLEUM ACQUIRES INTEREST IN GULF OF SUEZ CONCESSION

Beach Petroleum reports that it has entered into an agreement with Santos Egypt Pty Ltd underwhich, subject to waiver of pre-emptive rights by the Egyptian General Petroleum Corporation and the approval of the Government of the Arab Republic of Egypt, Beach will acquire, via a farmin arrangement, a 20% interest in the South East July concession, in the Gulf of Suez, offshore Egypt.

The South East July concession is currently held 100% by Santos and contains several attractiveoil prospects, one of which will be evaluated by the July South-1 exploration well in the fourthquarter of 2008.

Beach has also agreed to acquire Santos Egypt’s 25% interest in the onshore North Qarunconcession, located close to Cairo in the Gindi Basin of the Western Desert.

The agreement is subject to entry into formal documentation, waiver of pre-emptive rights by the Egyptian General Petroleum Corporation and other joint venture parties, and the approval of the Government of theArab Republic of Egypt.

The acquisition of these concessions is a result of Beach’s efforts to expand its exploration program internationally to give the company exposure to projects which have the potential to make material additions to its reserve base. This work has resulted in the identification of several opportunities in Egypt (in addition to South East July and North Qarun) which are currently under evaluation.

Cockatoo Coal

How high can it fly?

Petterson Securities Limited, on it last report on Cockatoo, still maintain a BUY recommendation. New target price is $1.73

Report can be seen at: http://www.cockatoocoal.com.au/research.aspx

It looks quite promising, and will have a deeper look at it.

Buy in May? And...

Oh wait a second, is this really happening? Or is this just another dead cat bounce.. Well in this case, the poor dead cat bounce too high to pass the 6000 mark.

I'll be kicking myself if it's really just a dead cat bounce (although I got the feeling that it's not), but there's also a widely known share market axiom: Sell in May and go away..

Now, witnessing current condition of our ASX, the question is: Is this month of May, a good time to buy?