Press the Ignore Button!

Is It Worth the Paper It's Written On?

ALAN KOHLER: And so you’ll sue them next April if they don’t pay, is that right?

TREVOR ROWE: We will if they don’t pay in April we have an obligation under the underwriting agreement that we need to pursue the collection of any outstanding instalments, but we get the money anyway because it’s underwritten by Deutsche Bank and Macquarie Bank.

ALAN KOHLER: But you are obliged to pursue the people.

TREVOR ROWE: We are obliged to pursue people.

ALAN KOHLER: And so are you going to do that? Is in there any alternative that you’re looking at? Is there any possible alternative?

TREVOR ROWE: We have an obligation to use best efforts to recover those funds. So in a balanced way we will have to do that.

ALAN KOHLER: What will that involve? Will you put the debt collectors on to them?

TREVOR ROWE: We’ll probably have debt collectors go out and endeavour to collect it, yes.

The Cycle of Market Emotions

Sympathy does not seem appropriate

The geniuses at Porsche have just done what half the civilised world has been thinking of doing these past few weeks and stuffed it to hedge funds and banks. The numbers are still all over the place as people try to unravel the great Stuttgart Sting. But what appears to have happened is this.

Porsche had been itching to buy Volkswagen for years. But it was struggling to raise the money. So instead of getting a traditional bank loan or issuing equity, it decided to pick the pockets of British and American hedge funds, the very funds, in fact, which have belittled stodgy old German enterprise and called it out of date. The funds which one leading German politician called "locusts" for preying on businesses while adding no value.

These funds thought VW was overpriced and reckoned Porsche was insane trying to buy it. It was nothing but a quixotic fantasy of Ferdinand Piech, the grandson of Porsche's founder and a former chief executive of VW. Porsche, after all, had annual revenues of just £5.2bn to VW's £83bn. Its market cap was around a third of its takeover target.

British and American hedge funds have belittled stodgy old German enterprise and called it out of date

But Piech's intimate knowledge of VW had allowed Porsche to make enormous profits trading options on VW stock. What occurred over the weekend was the climax of this strategy. Hedge funds such as SAC and Greenlight in the US and Odey and Marshall Wace in London were eagerly shorting VW stock; borrowing, selling it and promising to return it later. They reckoned the stock price would fall and they could buy it back cheaply and pocket the difference.

What Porsche appears to have known, however, is that the volume of available shares was quickly dwindling. They knew this because they had been quietly building their own position in VW, through shares and derivatives, to 74 per cent of the firm. A further 20 per cent was owned by the government of Lower Saxony, and another five per cent owned by index tracking funds, leaving a tiny number of shares floating freely on the market.

It is conceivable that Porsche and its banks were the ones lending the hedge funds the shares and then buying them back through proxies. So while the hedge funds thought there was a large and liquid market in VW shares, Porsche knew otherwise.

On Sunday afternoon, Porsche played its hand. It announced that it controlled 74.1 per cent of VW. German law had not required it to disclose this information beforehand. The hedge funds did their calculations and freaked out. They had borrowed 15 per cent of VW and now it turned out Porsche may have lent them most of that.

They immediately began scrambling for what little stock was out there to close out their short position. Some were reported to be sobbing on the phone to their brokers. Too many traders chasing too little stock sent the price of VW soaring, pushing the company at one point on Monday past Exxon to make it the most valuable in the world. All Porsche needed to do at this point was sit back and smile. It had made billions in paper profits.

‘The chaos around VW overwhelmingly hit professional gamblers. Sympathy does not seem appropriate’

Then came the reckoning. On Wednesday Porsche announced it would release five per cent of VW's stock to ease pressure on the short sellers. The share price of VW is still around two-and-a-half times where it was last week and Porsche could make around £5bn on this portion of its manoeuvre alone.

But even better, Porsche owned cash-settlement call options on 31.5 per cent of VW which, according to the New York Times, matured yesterday. If true, this earned them the difference in cash between 31.5 per cent of VW valued around last Friday's closing price of 210 Euros per share and yesterday’s price of 517 Euros, an astonishing return. When VW's price returns to normal, Porsche should have more than enough cash to buy control.

Germany seems to be on Porsche's side in all this. Die Tageszeitung, a liberal newspaper, wrote on Wednesday: "As opposed to previous speculative bubbles that cost a lot of small investors their money in the stock exchange casino, the chaos around VW shares overwhelmingly hits professional gamblers. Sympathy does not seem appropriate."

Naked short selling

John Templeton

- He is one of the past century's top contrarian.

- Looking for value investments, he called it 'bargain hunting'

- Search for companies that offered low prices and an excellent long term outlook.

- As a value-contrarian investor, he believed that the best bargains were in stocks that were completely neglected, those that other investors were not even studying.

Valuation of Stocks

Accounting wise, apparently it depends on how you calculate it. All the hype about the ‘Mark to market accounting’, which is the accused culprit of our current financial crisis. Well again, of course nobody made a mistake in dealing their business. It’s all about accounting. Right? Wrong!

Mark to market accounting, or also known as fair value accounting requires a close look at the risks in order to assess value. Did the trouble banks and financial institution looking closely at the risks? If institutions were accurately marking the books, they would have seen the problems they were experiencing months in advance and could have made the necessary adjustments, and we could have avoided the current crisis

Anyway, on the new development of this issue, Accounting bodies in the US and Europe responded by changing a few rules.

The International Accounting Standards Board (IASB) has confirmed a change to its rules allowing some assets to be reclassified and avoid be subject to a fair value calculation. The changes allow some assets to be moved from ‘held for sale’ or trade, which means using a fair value calculation, to ‘held for investment’ which does not. Deutsche Bank took advantage of new accounting rules, and shifted the income statement into a profit instead of a loss

SEC and the Financial Accounting Standards Board issued a clarification of the rules to say that “when an active market for a security does not exist, the use of management estimates that incorporate current market participant expectations of future cash flows, and include appropriate risk premiums, is acceptable.” It added that “the results of disorderly transactions are not determinative when measuring fair value,” which could mollify concerns about assets being marked down to fire-sale prices.

Whatever the accounting bodies decide, I hope it’s for the interest of everybody, especially investor, and I am not going into detail about the issue in this post.

Now, Back to the question: What is a value of the stock?

In accounting, there are several alternative in valuing the stock: It might be slightly different in some textbook, but basically one of the well known methods is a discounted cash flow (DCF)..

How does DCF analysis work? In simple terms a business is worth the present value of the cash flows that it will generate into the future. Those are the after tax cash flows available to shareholders – from today to forever. To calculate the after tax cash flows available to shareholders you will start with the revenues a business generates and deduct all the cash-based expenses that are incurred in obtaining those revenues (including taxes and capital expenditures).

Most corporate finance professionals are using this method.

However, apparently, Citigroup analysts have recently shifted from a discounted cash flow model of valuation to an enterprise value model.

The Enterprise value (EV) represents a company's economic value -- the MINIMUM amount someone would have to pay to buy it outright. An enterprise value model adds up the market cap and debt a company has, and then subtracts cash and cash equivalents.

Using an enterprise value model for a company shares could means, well, the end of the business itself. It means the analysts thinks that the company has a zero earning power, hence kaput!!

Lorenzo

China Story

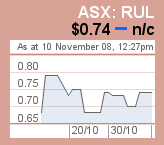

Directors Buy - Runge LTd (RUL)

Post Note: Ian Runge bought some more shares, 25000 on market on November 5 for $17500.

Post Note: Ian Runge bought some more shares, 25000 on market on November 5 for $17500. Runge director Ian Charles Runge indirectly bought 93,000 shares for $68,064 on-market on October 31. He indirectly holds 15,903,389 shares.

Ian was one of three or four Runge Directors who bought more into the company recently. Since October 2008, there are five notices of change in the directors ownership.

Among them were Anthony Kinnane who directly and indirectly bought 25000 shares for $18000 on market on 24 October 2008, Christian Larsen (bought 100000 shares worth $93500 on September 1, and Vince Gauci

Good sign and a vote of confidence.

RUL's vision is to be the leading global supplier of mine technical and business planning products and services. The company continues to strengthen its position globally, with demand for projects in new regions of the world. Demand from regions such as Russia, Brazil and China provide a solid foundation for the growth of its business globally. In terms of products and services, the company has been working on increasing the scope and size of the training business to handle a higher volume of recruits, and secondly, to reduce the complexity of its software products.

Runge reported NPAT up 6.2% to $5.94m for the year ended 30 June 2008. Revenues from ordinary activities were $63.41m, up 62.8% from last year. Basic EPS was 5.3 cents compared to 3.3 cents last year. Net operating cash flow was $5.9m compared to $6.35m last year. The final dividend declared was 1.5 cents.

Investing Tip 1: Don't Try to Catch a Falling Knife

Start looking for value playsTomas J. O'Loughlin, CFA, of Investment Portfolio Management, suggests that the best investment decisions in hard economic times are counterintuitive.

"Sectors or companies that you liked in good times but have been hit in today's markets may represent buying opportunities."

Buying the best of breed in these sectors can position investors to take advantage of the next bull market.

| His checklist in evaluating these firms includes: | ||||||||

|

An investor can't be in a hurry to buy or sell, says O'Laughlin.

"Don't try to catch falling knives," says O'Laughlin, and "try to get a measure of the firm's downside risk."

By looking at the downside risk of firms and by taking an investor's perspective, looking over a three- to five-year investment horizon, versus a trader's point of view, the investor can identify firms with value, O'Laughlin says.

From: http://www.bankrate.com/cnbc/news/investingadvice/tips-for-investing-a3.asp?caret=2a

White Knight Vs Red Dragon

This is from The Daily Reckoning in its newsletter yesterday:

Are these Chinese firms white knights or red dragons? Does it really make a difference? We're back to the same question of who benefits the most from the long-term demand for the ore. The Chinese steel producers have the chance of a lifetime to secure off-take from Australian mines at bottom-of-the-barrel prices. But what does it mean for current or future shareholders in the juniors?

Here's what Al says, "In short, the steel sector will huddle together for warmth over the next six months. We're going to see demand for steel and steel-making ingredients move down slowly. Then the recovery will come from developing countries later in 2009."

"But right now, the balance of power has definitely shifted. You'll see more of these iron-steel project equity agreements in late 2008 and early 2009. It's a way for both parties to get some security. It's a way to wring some risk out of the contracts. And it's yet another step towards where we see the iron industry inevitably heading: Chinese firms owning a lot more of Australia's iron mines."

"Shareholders in the juniors will be in for volatility. It still isn't clear in the long run who will control the Pilbara. But right now Australian iron ore shares are factoring in a global depression. The buyers are completely ignoring the growth in the developing world that'll come in the next decade. Better yet, our favourite iron play is still sitting on the sidelines - making cash every quarter regardless of who owns the mines."

Ansell Limited

Ansell's principle activities involve the development, manufacturing and sourcing, distribution and sale of gloves and protective products in the Professional Healthcare, Occupational Healthcare and Consumer Healthcare markets. Ansell is one of the companies in the Healthcare industries that has doing pretty well in the current financial crisis.

Ansell's principle activities involve the development, manufacturing and sourcing, distribution and sale of gloves and protective products in the Professional Healthcare, Occupational Healthcare and Consumer Healthcare markets. Ansell is one of the companies in the Healthcare industries that has doing pretty well in the current financial crisis.Telstra today - 5 Nov 2008

Citigroup maintain their HOLD recommendation on Telstra (TLS) and 465c target price saying they don’t expect any earnings upgrade at the TLS Investor Briefing tomorrow.

Citigroup maintain their HOLD recommendation on Telstra (TLS) and 465c target price saying they don’t expect any earnings upgrade at the TLS Investor Briefing tomorrow. Fundamental Analisys (I)

There are different of aspects that we can look into, but there are few basic things that we can start to look into:

1. Earning,

- Arguably one of the most important aspect of any business. Stock investors are focus on the future earning. However, since future is difficult to predict, they use the historical earning as a gauge to predict the future.

- Although looking at earning figures seems to be relatively easy, unfortunately there are few of different ways to look at a company's earning. This include the time of earning and the quality of earning. We will go into more detail of this earning in another post.

2. R/E Ratio

- P/E Ratio is calculated by dividing a stock price by its per share earning for a given years. Usually, we calculated the P/E based on a company expected earning ( this is what is called Forward P/E).

- It is a good place to start to determine the value of a stock, and it certainly most helpful to compare it against other P/E Ratios

- We might first compare it with the company's P/E ratio in the past, how high and how low it could go. Other than that we can also compare it with other similar company in the industry or the stock market index.

- Just because a stock has a relatively low P/E ratio, does not always mean it's worth purchasing. Others maybe aware of a looming problems and discounted the stock price accordingly. It can either good or a bad sign, always do your reasearch first.

3. to be continued...

What a Misjudgement!

Mount Gibson Iron (MGX) is back on the trade floor today, ending a week long suspension. It announced an offtake agreement, right issue and placement of 110m shares at 60c.

At least the company did not go to the darker place, but this is the same (or not the same) company who fought against the bought out at $3+ few months ago. The same predator is now getting 110 million shares at a 90% discount!!

I suppose this is as good as you can hope for.

Bank and the Borrowed Money!

Debt or borrowed money, became a huge industry around the world. The world turn away from manufacturing and toward an economy based on moving and managing money.

In the US itself, the sectors of finance, insurance and real estate sector swelled to 20% of GDP, ahead of manufacturing at 12%. Banks and insurers are dealing with obsecure instruments, debt papers, CDO. What a nightmare!